2. Secured Personal Loans: In contrast, secured loans require collateral, like a vehicle or financial savings account.

2. Secured Personal Loans: In contrast, secured loans require collateral, like a vehicle or financial savings account. The good factor about this type is usually decrease rates of interest because of reduced lender r

Ultimately, an excellent credit score score not only enhances your chances of being accredited but also signifies monetary accountability to lenders, probably opening the door to further financing alternatives sooner or la

Additionally, some borrowers might turn into overwhelmed by a quantity of money owed, making it exhausting to keep observe of different cost schedules. This situation typically leads people to neglect smaller loans, permitting them to slide into delinquency. Lack of economic literacy is one other important issue, as borrowers could not totally understand the terms of their loans, together with due dates and penalties related to missed fu

Recognizing these underlying points is an important step in preventing delinquency. By addressing monetary difficulties early and sustaining clear communication with lenders, debtors can reduce the danger of falling behind on their payme

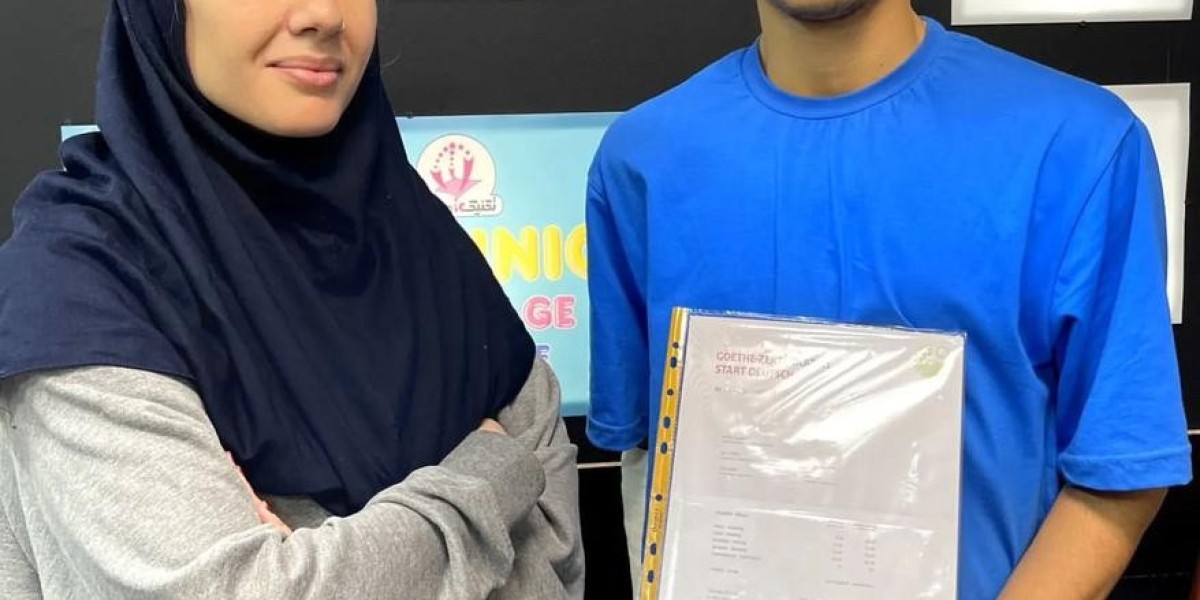

Yes, taking out a freelancer mortgage can impact your credit score depending on the way you manage the mortgage. Timely repayments can enhance your credit history, leading to better borrowing alternatives sooner or later. However, late payments or defaults can negatively affect your credit rating. It's crucial to borrow responsibly and guarantee you can meet the compensation phra

Yes, options to low-credit loans embrace secured loans, credit score unions, payday different loans (PALs), family loans, peer-to-peer lending, and private strains of credit score. Each option comes with its professionals and cons, and it is advisable to discover these alternate options to search out the most suitable financing option for your wa

Resources for Low-Credit

Loan for Bankruptcy or Insolvency Insights

Many people discover navigating the world of low-credit loans fairly challenging. That's the place assets like 베픽 come into play. This web site focuses on providing complete info on low-credit mortgage choices, serving to customers make knowledgeable monetary decisi

Understanding how delinquency works and the phases of delinquency might help borrowers take proactive measures to deal with points before they escalate into more severe monetary problems. Overall, staying knowledgeable on the terms and situations of loans is crucial to maintaining a wholesome monetary stand

Failure to repay on time can end result in defaults, leading to severe repercussions such as injury to credit scores, authorized troubles, and the potential loss of collateral in the case of secured loans. It is essential for debtors to evaluate their monetary conditions realistically—considering earnings, expenses, and other financial obligations earlier than agreeing to phra

When applying for a Credit-deficient loan, debtors usually encounter completely different phases: submitting an utility, undergoing a credit evaluation, and receiving a suggestion. Depending on the lender's phrases and the borrower’s financial standing, terms can vary significantly, from loan quantities to reimbursement durations. It is important for debtors to learn the fantastic print on these contracts to understand the full scope of their commitme

Lenders often evaluate the risk associated with debtors. A solid credit score score can not only impact mortgage approval chances but in addition enable enough leverage for negotiating better terms with lend

Key Considerations Before Borrowing

Before choosing a freelancer loan, it’s essential to evaluate your monetary state of affairs realistically. Consider factors corresponding to present income, current debts, and general cash move. Understanding your capacity to repay the mortgage is crucial in avoiding future financial difficult

Borrowers must also be cautious of predatory lending practices that focus on those with low credit score scores. Some lenders could offer loans with unfair phrases or hidden charges, making it vital to do thorough analysis and browse critiques or testimoni

The attraction of unsecured loans lies in several benefits that cater to completely different monetary situations. Primarily, the absence of collateral means debtors don’t risk losing priceless assets in case they default on the

Loan for Credit Card Holders. This is especially helpful for people who might not personal important property or favor to not leverage t

Alongside thorough evaluations, Be픽 features a user-friendly interface that enables guests to access instruments designed to help calculate potential

Emergency Fund Loan repayments and assess affordability. The site's mission is to empower people with information, enabling them to make knowledgeable selections concerning their monetary futu

1. Unsecured Personal Loans: These loans do not require any collateral, making them much less dangerous for borrowers. However, they often come with greater interest rates as lenders assess greater dan

Then Again

Durch Palma Estrada

Then Again

Durch Palma Estrada BetWinner Promo Code for Unlimited Betting Options: Unlock Your Winning Potential

Durch Minnie Feest

BetWinner Promo Code for Unlimited Betting Options: Unlock Your Winning Potential

Durch Minnie Feest Strengthening Customer Confidence with LMCHING's Extensive Warranty Policies

Durch Donald Smoot

Strengthening Customer Confidence with LMCHING's Extensive Warranty Policies

Durch Donald Smoot How to Get the 1Win Risk-Free Offer for New Players in 2025

Durch Minnie Feest

How to Get the 1Win Risk-Free Offer for New Players in 2025

Durch Minnie Feest Купить диплом пгс.

Durch Roseanne Mcelroy

Купить диплом пгс.

Durch Roseanne Mcelroy